Election Shows Canadians Aren't Joking About

The Conservative caucus grew from 95 to 121 thanks mainly to gains in B.C.,

Prime Minister Justin Trudeau

More than two-thirds or 71% of the ownership of oil sands production in

Spend C$4.5bn (US$3.45bn) Plus

To purchase

Kinder Morgan’s Trans Mountain Pipeline

The existing 300,000 barrel per day pipeline

Prime Minister Justin Trudeau’s repeated claims

A 800,000 barrels a day pipeline of crude to

In fact,

Today the majority of product now moved through the Trans Mountain pipeline ends up in Washington hands.”

Pipeline Expansion: US Refineries Win, Canadians Lose

U.S. west coast refineries are the most profitable in the world due to a relatively captive market and lack of competition

Washington refineries buying Alberta bitumen have some of the largest profit margins in the world

Kinder Morgan

Which splits off at Kinder Morgan’s Sumas Terminal in Abbotsford, B.C. and delivers tar sands to several refineries in Washington State,

Including the Ferndale Refinery (owned by Phillips 66),

The Cherry Point Refinery (owned by BP),

The Andeavor Anacortes Refinery

(now owned by Marathon Petroleum),

The Shell Anacortes Refinery (owned by Shell Oil).

The Puget Sound Pipeline currently has a capacity of 170,000 barrels per day (bpd), but in the documents filed for its IPO in May 2017,

American economic interests than protecting the environment.

for the most part, those who are most vocally against one ship a day serving

It has everything to do with enriching

Banking and paying out to shareholders

Alberta’s oil and gas companies have figured out how to pull off

The maximum oil tanker cargo allowed through B.C.’s

Burrard Inlet is an Aframax class ship at 80 per cent capacity

Plus ULCCs are the largest tankers in the world and

It cost 4 to 8 times more to ship oil from Vancouver to Asia

Set aside the political argument for buying the

Prime Minister Justin Trudeau

Spend C$4.5bn (US$3.45bn) Plus

To purchase

Kinder Morgan’s Trans Mountain Pipeline

Export Development Canada’s administration of a nearly

Kinder Morgan estimates the useful life of its pipelines at

Kinder Morgan pipeline is not worth much more than

It's all because Obama administration halted construction on

The remainder of the Keystone XL pipeline

A 800,000 barrels a day pipeline of crude to

Prime Minister Justin Trudeau’s repeated claims

The Pipeline has everything to do with enriching

Today our Current Outstanding Public Debt of Canada is approximate:

It wasn’t until 1973

Warned the government that low royalties for bitumen simply encouraged

The industry to export the heavy oil to

It's the lack of Competition and Gouging to

The government estimates Alberta is losing

Banking and paying out to shareholders

Today, they acknowledge climate change is happening,

The Supreme Court of Canada said

The Supreme Court of Canada said

Approved a tailings management plan for

Environmental mess that they have created over

They have been granted until after 2100 to

Canada will not be able to live up to its

Today it will cost you to clean up

The Cleanup bill is greater than the

Because there is shockingly poor regulatory oversight and lack of ambition on

National Geographic said

This is the world's most destructive oil operation

This is due to an

David Schindler, a former University of Alberta professor

and renowned freshwater scientist and officer of the

Governors of the Group of Ten countries of the member central banks of the

A key objective of the Committee was and is to maintain

The Committee discouraged borrowing from

Canadian taxpayers have paid one trillion,

The solution to this problem is simply for the government to stop borrowing

money from private lenders at interest and borrow from the

That right should be returned to the People of Canada

Young People Will Vote

Wanting Real Action On Climate Change

Alberta’s total emissions,

And by that measure the province is doing terribly.

Its oil sands alone did more damage to the climate last year than the entire economy of B.C.,

And Alberta’s per capita carbon emissions of 62.4 tonnes dwarf those of

The U.S. (15.53 tonnes) or even Saudi Arabia (16.85 tonnes).

This is why

Canada was just ranked 51st out of 60 countries in the

2018 Climate Change Performance Index

More than 63% of voters supported parties with substantial climate change platforms.

“Canada is truly divided now,”

For Alberta, Saskatchewan, it was 100% Pipeline

Alberta’s total emissions,

And by that measure the province is doing terribly.

Its oil sands alone did more damage to the climate last year than the entire economy of B.C.,

And Alberta’s per capita carbon emissions of 62.4 tonnes dwarf those of

The U.S. (15.53 tonnes) or even Saudi Arabia (16.85 tonnes).

This is why

Canada was just ranked 51st out of 60 countries in the

2018 Climate Change Performance Index

More than 63% of voters supported parties with substantial climate change platforms.

“Canada is truly divided now,”

For Alberta, Saskatchewan, it was 100% Pipeline

The election divided Alberta and Saskatchewan into Conservative majorities

Conservative's economic plan based on

Alberta, Saskatchewan, and New Brunswick.

But Andrew Scheer and his party lost support in the riding-rich Greater Toronto Area, and more widely across Ontario and Quebec.

Asked about concerns over Trans Mountain pipeline's future due to minority govt,

Alberta Premier Jason Kenney says if the prime minister means what he said on election night about listening to the people of Alberta & Sask.,

The clearest way is to commit to pipeline's completion

The Kenney war room is another blatant political ploy against both climate science and free speech; ironically,

It is partially funded by foreign oil companies.

Canadian producers want pipelines simply so they can capture the discount they currently lose on Canadian oil because their access is right now limited to only one export customer, the U.S.

The Kenney war room is another blatant political ploy against both climate science and free speech; ironically,

It is partially funded by foreign oil companies.

Canadian producers want pipelines simply so they can capture the discount they currently lose on Canadian oil because their access is right now limited to only one export customer, the U.S.

Said the pipeline will be expanded

This is what Prime Minister Justin Trudeau is selling Canadians

Economic cheerleading by federal and provincial politicians and the mainstream media on behalf of the oil industry

This is what Prime Minister Justin Trudeau is selling Canadians

Economic cheerleading by federal and provincial politicians and the mainstream media on behalf of the oil industry

is doing the public a great disservice.

It's time to tell the truth

This is why the Trans Mountain pipeline so valuable to

Prime Minister Justin Trudeau

Albertans aren’t told that

More than two-thirds or 71% of the ownership of oil sands production in

When the Trans Mountain pipeline is finish

Most of the benefits go to Foreign Entities and Big Businesses

Today the majority of product now moved through the Trans Mountain pipeline ends up in Washington hands.”

By Trans Mountain pipeline spur to Washington State

Or by Oil tankers outbound from Vancouver

Prime Minister Justin Trudeau

Today the majority of product now moved through the Trans Mountain pipeline ends up in Washington hands.”

By Trans Mountain pipeline spur to Washington State

Or by Oil tankers outbound from Vancouver

Prime Minister Justin Trudeau

Spend C$4.5bn (US$3.45bn) Plus

To purchase

Kinder Morgan’s Trans Mountain Pipeline

The existing 300,000 barrel per day pipeline

Prime Minister Justin Trudeau’s repeated claims

that the pipeline was essential for Canada’s future.

Declaring the Trans Mountain pipeline was a matter of national interest

It's all because Canada lost the Keystone XL pipeline South

Obama administration halted construction on

The remainder of the Keystone XL pipeline

Declaring the Trans Mountain pipeline was a matter of national interest

It's all because Canada lost the Keystone XL pipeline South

Obama administration halted construction on

The remainder of the Keystone XL pipeline

Terminals on the Gulf Coast.

This is why

This is why

Prime Minister Justin Trudeau

Bought

The Trans Mountain pipeline

Because It's the Backdoor to Washington State

Alberta oil products shipped through the Trans Mountain pipeline supplied 28.5 per cent of

Washington’s petroleum needs in 2017.Alberta oil products shipped through the Trans Mountain pipeline supplied 28.5 per cent of

In fact,

Today the majority of product now moved through the Trans Mountain pipeline ends up in Washington hands.”

Pipeline Expansion: US Refineries Win, Canadians Lose

U.S. west coast refineries are the most profitable in the world due to a relatively captive market and lack of competition

Washington refineries buying Alberta bitumen have some of the largest profit margins in the world

up to $45 US per barrel

Using the more conservative crack spread of $24 per barrel in 2016,

Trans Mountain will create massive potential profits for west coast refiners.

Adding hundreds of highly-paid refinery jobs in the state.

With an eventual capacity of 890,000 barrels per day,

U.S. refineries could pocket $7.8 billion US per year adding no value to Canadian crude

Not surprisingly,

Vancouver also has some of the highest retail gasoline prices in North America.” Using the more conservative crack spread of $24 per barrel in 2016,

Trans Mountain will create massive potential profits for west coast refiners.

Adding hundreds of highly-paid refinery jobs in the state.

With an eventual capacity of 890,000 barrels per day,

U.S. refineries could pocket $7.8 billion US per year adding no value to Canadian crude

Not surprisingly,

Kinder Morgan

The Trans Mountain pipeline has a southern leg

called Puget Sound Pipeline Which splits off at Kinder Morgan’s Sumas Terminal in Abbotsford, B.C. and delivers tar sands to several refineries in Washington State,

Including the Ferndale Refinery (owned by Phillips 66),

The Cherry Point Refinery (owned by BP),

The Andeavor Anacortes Refinery

(now owned by Marathon Petroleum),

The Shell Anacortes Refinery (owned by Shell Oil).

The Puget Sound Pipeline currently has a capacity of 170,000 barrels per day (bpd), but in the documents filed for its IPO in May 2017,

Kinder Morgan indicated that they want to significantly increase that amount, according to

Sven Biggs of Stand. Earth's Bellingham, Washington office.

This has been the plan all along,

In a widely published June 3 op-ed for Postmedia newspapers,

Thomas Gunton – a former B.C. Deputy Minister of Environment

decimated the Trudeau Liberals’ decision to buy

Kinder Morgan’s Trans Mountain pipeline and build its expansion project.

But instead of urging that the Trudeau government stop this controversial purchase,

Gunton stated this: “Ironically,

Their purchase of the pipeline may provide them with one last chance for changing course.

This would avoid tanker exports from Vancouver,

Reduce the number of Alaskan tankers

through Georgia Straight,

And allow for the phasing out of the higher risk aging pipeline.”

This suggested “redesign” to benefit

Washington’s major refineries may have been the plan all along, or at least since

November 15, 2016 when Gunton’s former boss

“to either Deltaport or just across the B.C.-Washington state border to the Cherry Point refinery”

in order to avoid “insurrection” in B.C.

This has been the plan all along,

In a widely published June 3 op-ed for Postmedia newspapers,

Thomas Gunton – a former B.C. Deputy Minister of Environment

decimated the Trudeau Liberals’ decision to buy

Kinder Morgan’s Trans Mountain pipeline and build its expansion project.

But instead of urging that the Trudeau government stop this controversial purchase,

Gunton stated this: “Ironically,

Their purchase of the pipeline may provide them with one last chance for changing course.

If they insist on building TMX they could appoint a multi-stakeholder task force including

First Nations to consider redesigning the project to reduce its worst impacts by scaling down the size of the expansion and directing increased shipments to refineries in Washington State.

Reduce the number of Alaskan tankers

through Georgia Straight,

And allow for the phasing out of the higher risk aging pipeline.”

This suggested “redesign” to benefit

Washington’s major refineries may have been the plan all along, or at least since

November 15, 2016 when Gunton’s former boss

B.C.’s former premier Mike Harcourt

Suggested that Kinder Morgan and the federal Liberals “consider an alternate route”

Suggested that Kinder Morgan and the federal Liberals “consider an alternate route”

To avoid Kinder Morgan’s Westridge Terminal in Burnaby.

Even before Trudeau had given federal approval to

Kinder Morgan’s expansion project,

Harcourt was here urging that the tarsands diluted bitumen (dilbit) be shipped“to either Deltaport or just across the B.C.-Washington state border to the Cherry Point refinery”

in order to avoid “insurrection” in B.C.

The Trans Mountain pipeline will only make Canada's problem worst

If the Pipeline does get build

Canadian oil would still be held ransom to a single, monopsony buyer in the U.S. at a discounted price;

Canada will be the next Venezuela

The campaign against Alberta oil is more about

American economic interests than protecting the environment.

“About $90 million over the last 10 years has gone towards various efforts to restrict oil and gas development and export

In an effort to land-lock Alberta oil so it cannot reach overseas markets, where it would attain a higher price per barrel

.

Yet, it has also struck many of us as an odd thing that,

for the most part, those who are most vocally against one ship a day serving

Canadian interests happen to be the branch-plant operations of powerful

American environmental organizations.

Those groups, and the various billionaire foundations, seem to believe they know better than Canadians do about what Canada's economic future should look like.

Gov. Inslee, who is co-chair of the U.S. Climate Alliance

Washington State Governor Jay Inslee endorsed

B.C.’s push to block construction of the federally approved Trans Mountain pipeline expansion.

This is why

And they want to keep it that way

BC.Gasoline and Diesel Prices Inquiry said

This is why

Washington refineries buying Alberta bitumen have some of

The largest profit margins in the world

up to $45 US per barrel

U.S. west coast refineries are the most profitable in the world due to a relatively captive market and lack of competition

The largest profit margins in the world

up to $45 US per barrel

U.S. west coast refineries are the most profitable in the world due to a relatively captive market and lack of competition

And they want to keep it that way

BC.Gasoline and Diesel Prices Inquiry said

The Trans Mountain pipeline it had nothing to do with

U.S-.based refineries with no value added in Canada.

That is exactly what they are doing

It's Bankruptcy in Canada and Incredibly Profitable in USA

“The Big Five”

Were performing relatively well

"incredibly profitable corporations,"

$13.5 billion last year.

“bankruptcy-for-profit”— and it’s

Prime Minister Justin Trudeau

Said the pipeline will be expanded

However, the Liberals still need to find $10 to $15 billion to build the pipeline.

It will create 2,500 temporary construction jobs over two years with 90 permanent jobs.

But instead of ending at the Vancouver terminus,

It would follow the existing secondary route from Sumas, B.C. into Washington state,

Taking Alberta oil to the aforementioned three existing refineries in Cherry Point and Anacortes, Wash.

Why

The B.C. government proposed limiting any increase in shipments

Of diluted bitumen amid concerns about spills.'

Burrard Inlet is an Aframax class ship at 80 per cent capacity

Carrying 550,000 barrels,

Only about one-quarter the load of a VLCC.

They can carry two million barrels at a time

They carry up to 4 million barrels of oil.

Refiner in Asia would have to book and pay for four to eight tankers

Where would that leave Canadian interests?

Well, Canadian oil would still be held ransom to a single, monopsony buyer at a discounted price;

Every planned drop of oil will still be produced;

Whatever risk there is to the Pacific Coast would simply be moved 60 miles south and put under American control;

Those refineries are currently supplied by oil shipped down from the Alaska North Slope fields by boats that regularly transit B.C. waters.

Production from that field is expected to decline by more than 150,000 barrels per day between now and 2026.

Oil tankers have been departing the Westridge marine terminal in Vancouver weekly since 1956.

Additionally, bulk tankers come from Alaska, down the west coast of Vancouver Island, through the Juan de Fuca strait, past Victoria and into oil refineries in

Cherry Point and Anacortes in Washington state

Whatever economic and environmental benefits

Canadians might have enjoyed would be lost;

Kinder Morgan pipeline and you’re left with a deal that makes no business sense.

(The pipeline is 67 years old.)

Without so much as a basic cost-benefit analysis,

Spend C$4.5bn (US$3.45bn) Plus

To purchase

Kinder Morgan’s Trans Mountain Pipeline

The existing 300,000 barrel per day pipeline

$5 billion loan to support the government’s controversial purchase and operation of the

Trans Mountain pipeline a 67-year-old infrastructure

30 to 64 years

According to Kinder Morgan’s financial statements.

$1 billion,

The remainder of the Keystone XL pipeline

A 800,000 barrels a day pipeline of crude to

Terminals on the Gulf Coast.

Arguing approval would compromise America’s effort to reduce its greenhouse gas emissions.

that the pipeline was essential for Canada’s future.

U.S-.based refineries with no value added in Canada.

“Virtually no exports go to any markets other than the U.S.,”

This Pipeline will only make Canada's problem worst

Oil will only go South to

U.S. refineries with no value added in Canada.

This is why

Alberta

The Five Big Canadian Companies

Together they now control almost

80 per cent of bitumen production

British Columbia

Control approximately 90 per cent of the

Market in Southern B.C.

Therefore, the wholesale gasoline and diesel market is an oligopoly.”

These companies control all 15 primary storage terminals in the province “and, along with

Federated Co-op Limited, control all the Bulk Terminals.

(Bulk terminals handle smaller volumes of fuel supplied by truck.)

The companies’ dominance makes it effectively impossible for competitors to enter the market, the report found.

“This oligopolistic wholesale market has the characteristics of a natural monopoly,”

More than two-thirds or 71% of the ownership of oil sands production in

The Truth is

The only benefit Canadians get is a Job to pay for roads, schools and hospitals

Canada should be one of the Richest Nations in the World

In addition to oil.

Canada has many other valuable natural resources

Here are the world rankings of Canada's natural resources:

Potash, #1

Uranium, #2

Oil, deposit #3 (production #6)

Nickel, #4

Diamond, #5

Salt, #5

Zinc, #6

Gold, #9

Copper, #9

The Canadian budget makes it abundantly clear where its revenues come from

It's not from Canada's natural resources

It comes from you

Today Canada is just teetering on the boundary

697,735,366,381.26 CDN.

Believe it or not

Alberta

That the province tied royalty rates to the volatile price of oil.

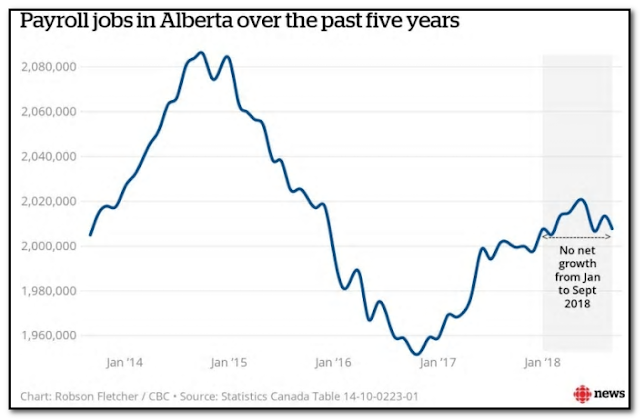

Today Alberta

Will be $67 billion of debt by the time the

Alberta is on pace to be $96 billion in debt by 2024

This is a dramatics change in fortunes for a province

That celebrated being debt free 20 years earlier

Alberta: spending more than we really earn, since 1970

Moody's downgrades Alberta's credit rating,

Citing continued dependence on oil

You know, until we can wean ourselves off of royalty revenues to fund government operations,

On Friday, unions were told to expect thousands of public sector job cuts.

PLUS

Moody's downgrades Alberta's credit rating,

Citing continued dependence on oil

You know, until we can wean ourselves off of royalty revenues to fund government operations,

On Friday, unions were told to expect thousands of public sector job cuts.

PLUS

Then Canada Buys back the oil at Full Market Price

The Alberta government collected more

That it did in royalties from oil companies

Canada is now Number ONE in the world for Subsidies

In 2015, Barry Rogers of Edmonton-based Rogers Oil and Gas Consulting

The industry to export the heavy oil to

U.S. refineries with no value added in Canada.

That is exactly what they are doing

It's Bankruptcy in Canada and Incredibly Profitable in USA

The growing discount has cost Alberta’s provincial treasury dearly

Canada’s non-renewable energy resources

Calgary Oil and Gas Execs want to keep it that way this is

Why

Canada oligopolistic wholesale market has the characteristics of a natural monopoly

Because of "Air Barrels"

Alberta is losing billions every year

To Fight “Air Barrels”

$80 million a day due to this discount,

Alberta will never be able to stop “Air Barrels”

Instead of fixing the problems

“The Big Five”

Were performing relatively well

"incredibly profitable corporations,"

$13.5 billion last year.

It's Jobs over the Environment

Only 6 percent of the provincial total now.

For decades, the oil industry denied climate science or that global warming was caused by burning fossil fuels.

but are doing everything possible behind the scenes to ensure no action is taken, according to InfluenceMap. and everyone in Canada

This “soft” climate denialism appears to have been embraced by Scheer and the Tories.

The Alberta Tar Sands have been dubbed the largest

Industrial project in human history

Alberta is sweeping the problem under Water

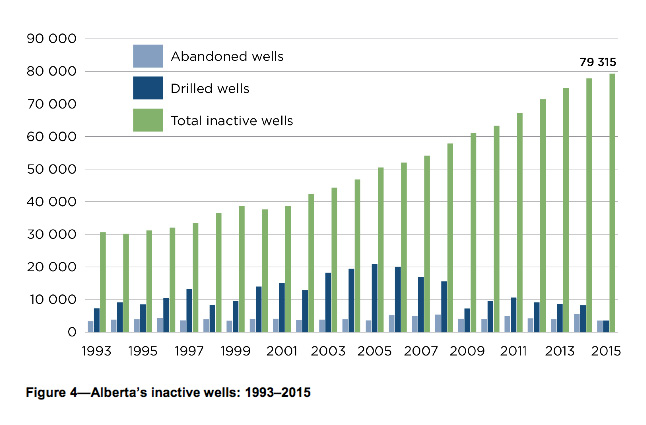

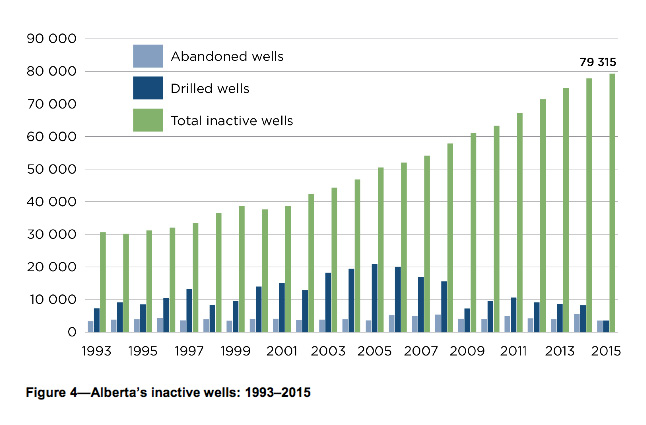

Crazy Days in Alberta:

The Poison Wells File

Tailings Ponds is Worse Than Ever

Crazy Days in Alberta:

The Poison Wells File

Tailings Ponds is Worse Than Ever

The Cleanup bill is greater than the value

The Supreme Court of Canada said

The Supreme Court of Canada said

Owners must deal with old oil wells so

The governing Alberta NDP and the official Opposition

Told the provincial legislature Tuesday

Alberta’s oil patch isn’t an emergency now,

Because they now over 70 years to

Figure out how to clean up their tailings and reclaim the land.

The NDP and the United Conservative Party

Made the statements as they teamed up

To shut down emergency debate on the issue,

Proposed by Liberal MLA David Swann.

While Suncor’s mine will close down in 2033,

They have been granted until after 2100 to

Figure out how to clean up their tailings and reclaim the land.

The NDP. Government of Alberta

Suncor Energy Incorporated,

The oldest mining company in the Canadian tar sands.

By approving this plan,

Suncor will get an additional 70 years after their operations

Shut down to clean up the

60 years of oil extraction.

Canada's most shameful environmental secret

Figure out how to clean up their tailings and reclaim the land.

It could take nearly 300 years for the industry to abandon

All of its wells, let alone clean them up,

Oil and gas companies can receive certificates for site clean up

With the click of a button,

Canada was just ranked 51st out of 60 countries in the

Weighed down in large part by a certain oily elephant north of Edmonton.

“That’s catastrophic levels of change in a short period of time.”

This is making Canada the laughing stock of the world

This is not normal':

Canada subsidized the fossil fuel industry to the tune of almost $60 billion — approximately $1,650 per Canadian.

Alberta's oil patch? $260 billion

$200 billion more than has been publicly reported.

In 100 years only $1.2 billion has been invested in Clean up

Value of the entire oil and gas industry

“Canada wants to be a climate champion and"

Canada does not have the money to clean up the oil fields so

Canada is sweeping the problem under Water

Tailings management progress in Alberta,

Tailings Ponds are Worse Than Ever

This is the world's most destructive oil operation

Alberta policy unique in North America.

Companies have no deadlines to clean up abandoned wells.

Oil sands waste is collected in sprawling toxic ponds.

To clean them up, oil companies plan to pour water on them

and renowned freshwater scientist and officer of the

Order of Canada.

Two Alberta courts previously ruled that private creditors of bankrupt

Redwater Energy Corp.

Were first in line for liquidated assets,

Ahead of its obligation to pay for environmental cleanup.

This is the problem of taxpayers and Landowners.

The oil and gas companies aren’t setting aside the money to clean up

Their own Mess

Guess who is going to pay for it?

You guessed it: The rest of us so

In 1974 the Basel Committee was established by the central-bank

Bank for International Settlements (BIS), which included Canada.

“monetary and financial stability.”

To achieve that goal,

A nation’s own central bank interest-free

All in the name of “maintaining the stability of the currency.”

Our Current Outstanding Public Debt of Canada is approximate:

$629,572,079,450.28 CDN.

Rather than creating money through the Bank of Canada interest-free.

($1,100,000,000,000) in interest on the federal debt to private lenders.

This accumulated debt was monies borrowed to service the debt,

Essentially a payment of interest on interest

To understand how ridiculous the present situation is,

Consider the 1993 Auditor General of Canada report

This “subsidy” to the private lenders must end.

money from private lenders at interest and borrow from the

Bank of Canada at no interest.

The private banks should also be prevented from creating money.

Through the Bank of Canada.

This is one reason why Canada is the next Argentina

The Government and the Oil industry has good reason to be alarmed.

No comments:

Post a Comment